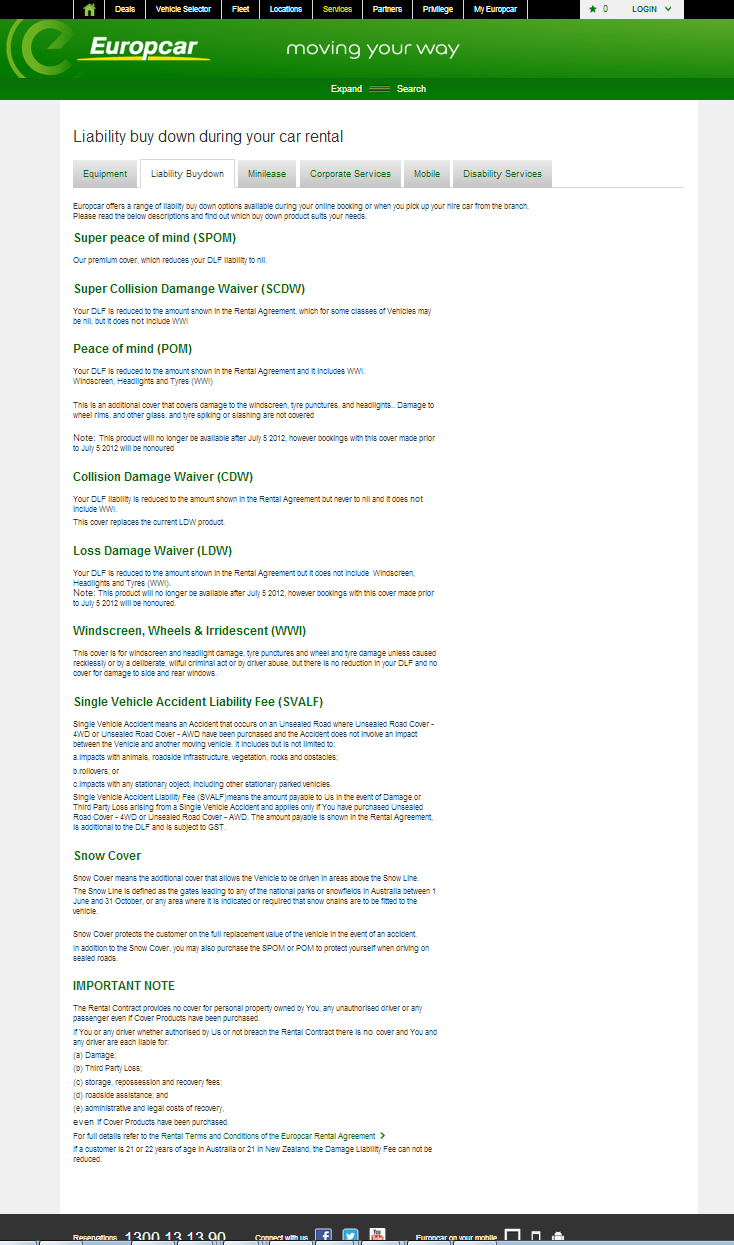

Now I don’t want to be cynical but I cannot work out why Europcar do not include any rates for their excess and the rates to buy down my exposure.

http://www.europcar.com.au/EBE/module/render/liability-buy-down

Their latest site has the tagline “moving your way”. Well if they were moving my way ans the way of the trades practices act they would be including their rates with full disclosure

of any fees on top so that I can make an informed decision.

I have emailed them the following below and am still waiting for their reply stay tuned.

Can you tell me the excess I would be up for and how much does

each buy down cost?

BTY I am wondering why you simply do not have these rates on your website??

Regards

Des XS

Europcar’s reply:

Thank you for your enquiry,

We are unable to respond from this address in relations to your enquiry; however we

are more than happy to assist you with your requirements by contacting us on the

following for an immediate answer.

Contact Europcar Reservations Centre by Phone

When I rang the reservation centre and asked them if they would send me the buy-down rates to reduce their excess she refused, offering to just tell me over the phone.

Do we treat hire cars the same as we treat our own cars? There have long been jokes about the invincibility of rental cars. Like most jokes, they are funny because they are based in reality. For some reason, the urge to drive a hire car slightly more aggressively than you drive your own is something that fills even the most meek driver. Why? Because hey, why not?

Do we treat hire cars the same as we treat our own cars? There have long been jokes about the invincibility of rental cars. Like most jokes, they are funny because they are based in reality. For some reason, the urge to drive a hire car slightly more aggressively than you drive your own is something that fills even the most meek driver. Why? Because hey, why not?